Vision for CYBICA

Vision for CYBICA

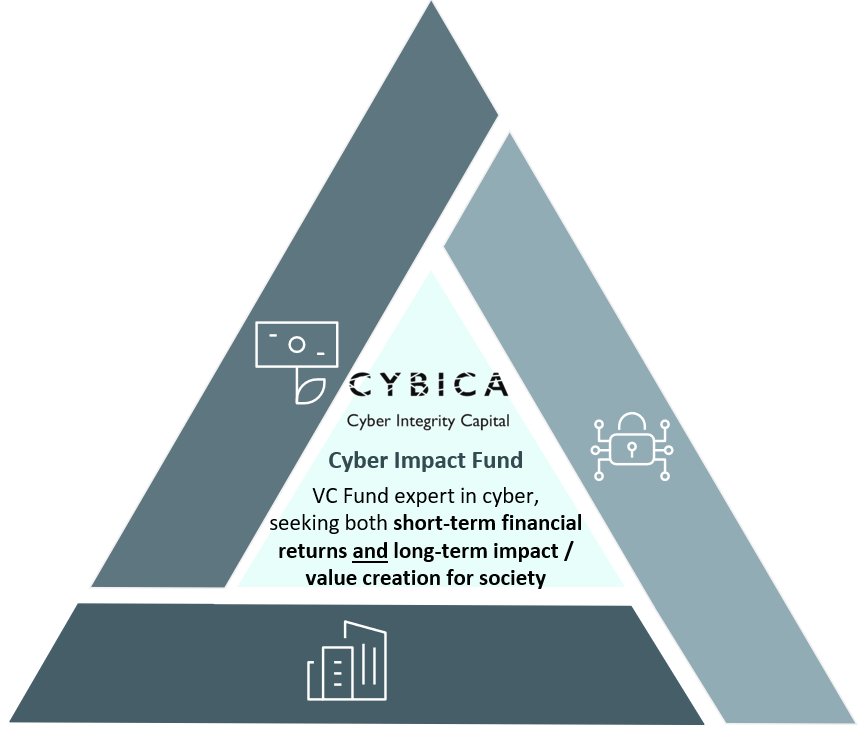

Several types of investment vehicles invest in early-stage solutions that address these threats, but none of them combines technical cyber expertise with the vision of establishing sustainable digital infrastructure in Europe

CYBICA is the first Cyber Impact Fund in Europe.

CYBICA is the first Cyber Impact Fund in Europe. In the US, Ex/Ante VC Firm is a successful example of a Cybersecurity Impact Fund, supported by former Google CEO Eric Schmidt

In the US, Ex/Ante VC Firm is a successful example of a Cybersecurity Impact Fund, supported by former Google CEO Eric Schmidt